Do Individual Investors Trade on Investment-related Internet Postings?

- Manuel Ammannt and Nic Schaub

- Management Science, 2020

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions

We have written in the past about the links between social media, investing and future stock returns ( here, here, and have a full chapter covering the topic in our book). As we turn to social media for our friendships, entertainment, confirmation bias, and news, it’s little surprise that active traders would begin using it as a potential source of sentiment information and/or as a way to ‘talk their book.’ That investors are turning to these new sources for information isn’t particularly shocking, however, these developments may become more informative going forward as smaller investors have been re-entering the market. In this paper, the authors ask:

- Do individual investors rely on investment-related Internet postings when making investment decisions?

- Do postings help individual investors identify investment strategies that deliver superior performance in the future?

- Are there cross-sectional differences in the relation between comments posted by traders and the trading behavior of followers?

What are the Academic Insights?

The research team analyzed a leading European social trading platform, the sample is made up of about 30,000 comments from traders with replicating transactions of followers, which amounts to €234 million over the time period from January 2013 to December 2014, the authors find:

- YES- The posting of comments is associated with a significant increase in the trading activity of followers. In fact, if a trader posted a comment yesterday, today’s net investments of followers in the shared trading strategy increase by about 6% compared to the average daily net investments for the same portfolio (and higher activity lasts for about 3 weeks). Additionally, when looking at the tone of comments, a one standard deviation increase in the fraction of positive words is associated with a significant increase in net investments of followers by about 4% on average.

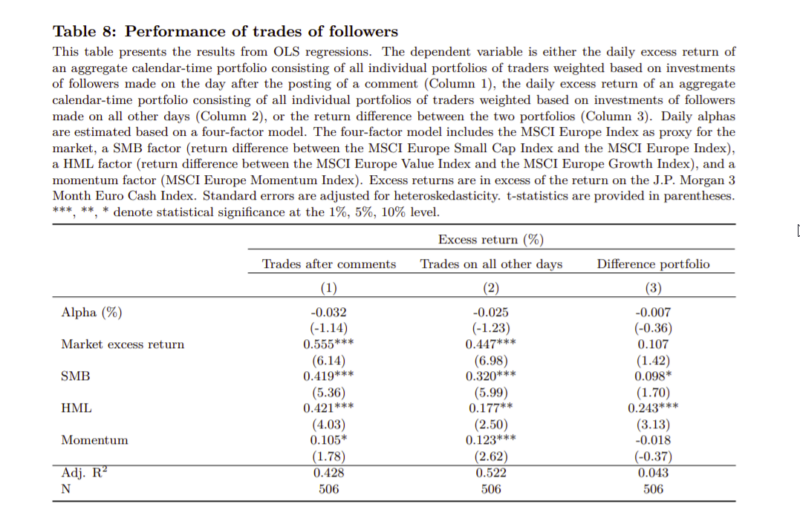

- NO- Neither the posting of comments nor the tone of comments have predictive power for the future performance of traders’ portfolios. Additionally, trades of followers executed after the posting of comments deliver about the same performance as trades of followers executed on all other days. Both types of trades tend to underperform common benchmarks.

- YES- A highly significant reaction following the posting of comments for small investors but no reaction for large investors. This suggests that it is mainly unsophisticated individuals who rely on investment-related Internet postings when making investment decisions.

The authors perform a number of robustness checks confirming the results.

Why does it matter?

Investors hunting for an edge will turn anywhere and the less sophisticated investor can be convinced that they “know” something by finding an “expert” on a social media platform to guide them to higher returns. This paper suggests that it is primarily unsophisticated individuals who rely on the opinions of others shared on social media platforms when making investment decisions, but there is not much evidence that online postings help those unsophisticated individuals improve their investment quality.

The Most Important Chart from the Paper:

Abstract

Many people share investment ideas online. This study investigates whether individual investors trade on investment-related Internet postings. We use unique data from a social trading platform that allows us to observe the shared portfolios of traders, their posted comments, and the replicating transactions of followers. We find robust evidence that followers increasingly replicate shared portfolios of traders after the posting of comments. However, postings do not help followers identify portfolios that deliver superior performance in the future. In a cross-sectional analysis, we show that it is mainly followers who are typically considered to be unsophisticated who trade after comment postings.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.