The Liquidation of Government Debt

- Carmen Reinhart and M. Belen Sbrancia

- A version of the paper can be found here

- A video of Prof. Reinhart discussing financial crises

- Note: this is an updated version of a post I wrote almost 4 years ago

Abstract:

Historically, periods of high indebtedness have been associated with a rising incidence of default or restructuring of public and private debts. A subtle type of debt restructuring takes the form of “financial repression.” Financial repression includes directed lending to government by captive domestic audiences (such as pension funds), explicit or implicit caps on interest rates, regulation of cross-border capital movements, and (generally) a tighter connection between government and banks…Inflation need not take market participants entirely by surprise and, in effect, it need not be very high (by historic standards)…We describe some of the regulatory measures and policy actions that characterized the heyday of the financial repression era.

Data Sources:

Primary sources, doing good old fashioned data collection. Prof Reinhart keeps various data from her papers here.

Discussion:

There is one concept that most people in the world understand (except politicians and American consumers):

You can only spend what you can earn.

Over short-term horizons this equality may get thrown out of balance because of borrowing/lending, but AT SOME POINT, the total discounted value of your earnings needs to match up with the total discounted value of your spending. This should be true because creditors aren’t stupid. For example, I’d love to go borrow a billion dollars from the bank and buy a few private islands, a militia, a 1000 xbox games, a 50ft LCD TV, and a platinum football field. Unfortunately, the bank is going to look at my earnings profile and quickly determine that their loan will go bad with 100% certainty–they will certainly not lend me the money to spend more than I can ever possibly earn.

Governments are a bit different…

For some reason, governments forget the concept of spending what you earn, and instead spend A LOT MORE than they earn. Unfortunately, governments don’t face the same level of disciplining measures that individuals and businesses confront (i.e., you and I can’t borrow a billion dollars to buy a platinum football field, but the government could find ways to make this happen). Because it is difficult to impose credit enforcement on governments (lack of transparency, lobbyists, pork barrel spending, uninformed voters, political spin, etc.), they often are allowed to create large debt/GDP ratios over time.

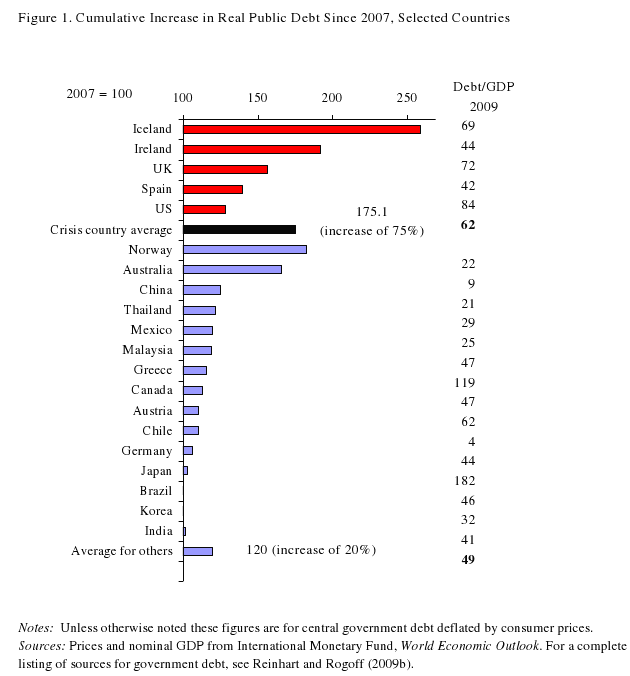

The figure below highlights this concept:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Debt is not necessarily a bad thing: it might help governments smooth consumption, finance projects that require lumpy initial cash outflows, or help supplement demand gaps during recessions/depressions, etc. However, overwhelming debt IS an issue because you can run into financial distress and bankruptcy predicaments. Governments eventually realize they are going bankrupt and devise schemes and methods to liquidate the government debt.

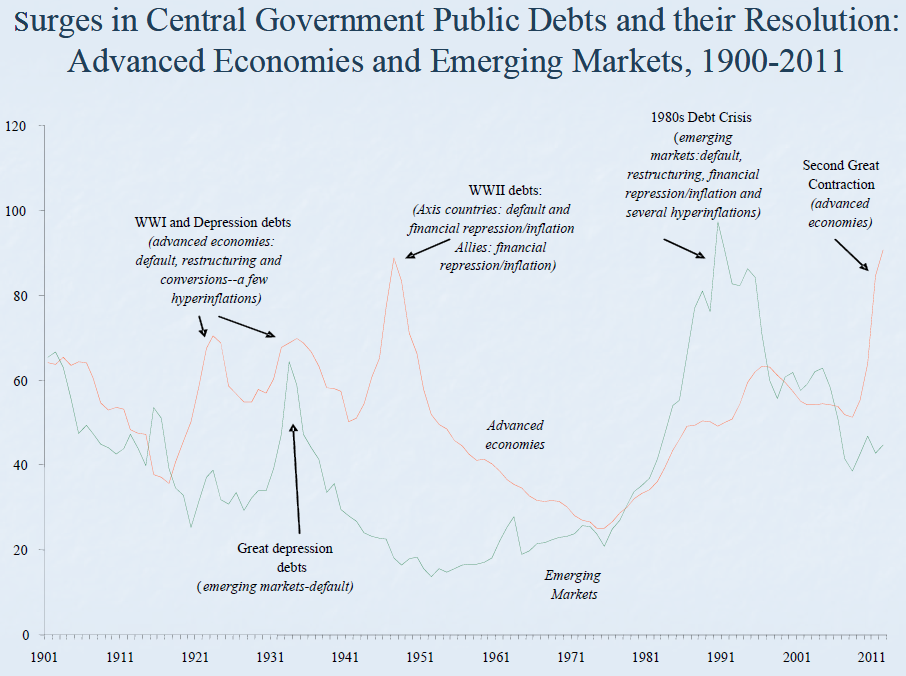

How governments liquidate their debt is the central topic of this paper, and one that promises to be very relevant to investors and society as a whole going forward. Check out the graph below and focus on 2011–certainly looks like some debt needs to be liquidated based on historical precedent…fast forward 4 years and the situation is even worse!

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

If we know we are facing a debt liquidation episode, it would make sense to understand how the government will address the issue, and position our portfolios to maximize profit (or in this case, minimize damage!)

To tackle this macroeconomic question, the authors outline the methods that governments have historically used to monetize debt (we are focusing on domestically-held debt here):

- Grow out of the problem–Economic growth

- Tough love–fiscal adjustment/austerity

- Give up–default or restructuring

- Inflate away–sudden surprise burst of inflation

- Stealth liquidation–steady financial repression (impose regulations and incentives that make debt artificially attractive) and steady inflation

It has long been assumed that the United States and Western European nations simply grew their way out of the massive debt problems they faced in the aftermath of WWII. What Reinhart and Sbrancia show is that, between the 1940s and the start of the 1980s, these governments made a concerted use of option 5: stealth liquidation. And, in fact, debt levels dropped dramatically over the course of three decades. Debt levels began to rise again during the period of liberalization marked by the 1980s and 1990s, as governments abandoned “financial repression.”

So which option will governments choose in the current environment?

If you sit back and think about it–or if you read PEW research polls on a frequent basis–the political feasibility of options 2, and 3 are next to impossible because of political gridlock; option 1, while appealing, does not seem reasonable.

With options 1, 2, and 3 off the table, the only reasonable options we can expect are 4 and 5. Option 4, while hard to completely control, is certainly not a good option for politicians who care about maintaining their position of power (hyperinflation doesn’t typically lead to re-election). This leaves us with option 5 as the most reasonable option.

What exactly is financial repression?

Direct from the authors:

… includes directed lending to government by captive domestic audiences (such as pension funds), explicit or implicit caps on interest rates, regulation of cross-border capital movements, and (generally) a tighter connection between government and banks.

It is a subtle type of debt restructuring…

What are some financial repressions methods governments have used in the past (to include the US! See Table 2 in the paper)?

- Explicit or indirect caps or ceilings on interest rates

- Regulated rates (e.g., government-mandated caps on savings deposits), interest rate targets (e.g., through central bank open market operations — buying/selling government bonds), etc.

- Creation and maintenance of a captive domestic audience

- Force domestic investment through regulation (e.g., through exchange controls, high reserve requirements for banks, gov’t bond holding requirements for banks, taxes on alternative investments (equity, corp bonds, etc)

- Control banking sector

- Eliminate entry, direct ownership of and/or management of banks, direct credit to certain industries.

What is the intent of financial repression policy?

Lower real interest rates on government debt, which is essentially is a hidden ‘tax’ on savers.

What is the intent of an inflationary policy?

Lower real interest rates on government debt, which is essentially a hidden ‘tax’ on savers.

Imagine the appeal of a policy that allows politicians to stealthily restructure debt and inflate away nominal bond value in one package? Very hard to resist!

In their concluding remarks Reinhart and Sbrancia note the usefulness of financial repression in confronting the problem of British sovereign debt in the post-WWII period:

Following the Napoleonic Wars, the UK’s public debt was a staggering 260 percent of GDP; it took over 40 years to bring it down to about 100 percent (a massive reduction in an era of price stability and high capital mobility anchored by the gold standard). Following World War II, the UK’s public debt ratio was reduced by a comparable amount in 20 years.

But perhaps this is an ambiguous example. Despite the UK’s massive debts in the 19th century, and the slow pace of liquidation, the nation still was able to forge what was probably the greatest empire the world has ever seen. On the other hand, the sun had clearly set on the British Empire by the 1950s and 1960s when the UK government was liquidating its debt so efficiently.

Is large-scale public debt an obstacle or an instrument of national greatness?

I’ll refer you to the paper to get the nitty gritty historical facts on other individual government debt liquidations; however, here is the punchline that might improve your asset allocation mix going forward: financial repression and steady inflation seemed to have worked well for debt-burdened governments in the recent past.

Commentary:

This paper, along with actual happenings in the current marketplace, suggest that the US–and other high debt/GDP countries–are using history as a guide to help them liquidate debt in a politically feasible manner.

Here are some simple examples of possible financial repression in the marketplace:

- Heavy handed regulation and control of financial institutions is well underway (first step in facilitating financial repression). All of this regulation is being marketed as “for the public good.”

- Governments are playing a larger and larger role in government bond markets (QE1, QE2, and QE3?). It is no longer possible to look at a yield curve and believe it reflects market-priced risk.

- Governments are pushing for more and more domestic debt ownership (easier to manipulate domestically-held debt).

On the inflation front, most countries still maintain that their goal is to maintain ‘healthy’ inflation rates.

The stage seems to be set for an age of financial repression and steady inflation that will slowly liquidate the debt of overburdened countries. And if we believe this thesis, the implications for long-term investment policy may be the following:

- Minimize ‘hyper-inflation’ hedges, since that is not necessary

- Avoid ‘default’ bets like CDS on the US government

- Avoid institutions that have a higher probability of government ‘capture’–e.g., insurance companies, financial companies, index/pension funds, or anyone else that has to hold treasuries because the government forces them to.

- Avoid government debt.

- Focus on debt and assets in non-indebted countries, and fund it with the high-debt country debt!

Of course, pontificating on macroeconomic policies and their effects, while entertaining, has never really shown to help portfolio investment decisions. As Meb so eloquently outlines in his new book, “Global Asset Allocation,” asset allocation doesn’t really matter that much.

We’ll check back in twenty years down the road and see how it all plays out.

***thanks to Dave Woodworth for thoughts/comments.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.