One of the more fascinating findings from psychology research is the empirical finding that simple models often beat experts.

In other words, insights from your “gut” often smell like Sh#$.

Experts have been bested by simple models in a variety of arenas. Some favorites:

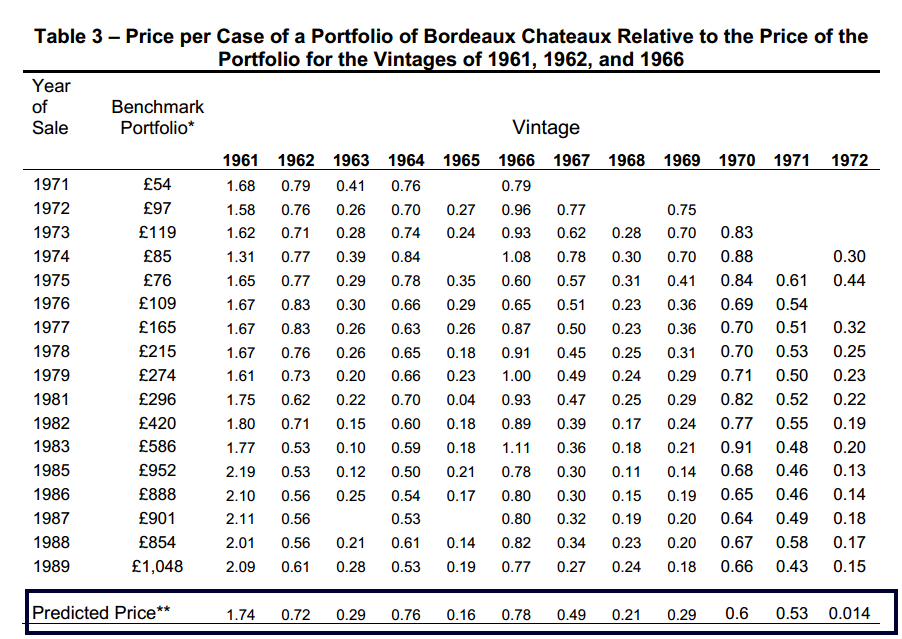

Wine Quality

Brain Damaged?

Leli and Filskov (1979) reported cross-validated classification accuracy that equalled 83% for a discriminant function derived on two measures of intellectual deterioration. This investigation made a preliminary assessment of the clinical utility of this function through a clinical-actuarial classification paradigm. Wechsler-Bellevue Intelligence Scale Form I protocols from 12 nonpsychotic nonimpaired and 12 cerebrally impaired individuals were used by experienced clinicians and predoctoral interns to identify the presence of intellectual deterioration associated with brain damage through their own clinical experience (Clinical Judgment condition) and, then, in conjunction with the discriminant function (Clinical-Actuarial condition). The classification accuracy from the discriminant function weights (Actuarial condition) and those from clinicians in the Clinical-Actuarial condition were statistically comparable and significantly above chance levels. These results indicate that the clinician who is assessing for the presence of intellectual deterioration associated with brain damage should rely heavily upon a valid actuarial index.

Psychotic vs. Neurotic

But, what do we call that process which is characterized by a disruption of the naturally occurring order of observations plus immediate feedback on cue-criterion links, followed by some concrete form of tallying the accuracy of one’s hypotheses? We call it RESEARCH [authors emphasis]

One of the greatest pieces written on the subject comes from none other than James Montier:

Painting by the Numbers

Could it be the case that simple models beat “experts” in the stock market? I’m not sure, but the evidence from our book certainly suggest this to be the case!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.