The underlying concept of magic formula investing is a genius marketing platform, but it is unclear how “magic” the formula actually is–examine ‘cheapness,’ examine ‘quality,’ combine the analysis and buy the best value (get the most bang for your buck). The magic formula identifies quality via EBIT / (NPPE +net working capital) and cheapness via EBIT / TEV. These two measures are certainly not ‘bad’; however, they are also not necessarily optimal.

We are always exploring alternatives to the magic formula found in academic finance research. In fact, we highlighted the ‘academic version’ of the magic formula in the following post:

http://alphaarchitect.com/2011/02/the-other-side-of-value/

The “profit and value” strategy identifies cheapness via book-to-market, and identifies quality via gross-profits-to-total-assets.

Next, we backtested the magic formula and the profit and value system and compared them in a head-to-head battle. We tested a portfolio that is annually rebalanced on June 30th (only stocks >80% NYSE market cap breakpoint are included). The portfolio is rebalanced across 30 stocks on July 1st and held until June 30th. Total returns, gross of costs. Benchmarks are the S&P 500 TR Index and the Value-Weight CRSP Index.

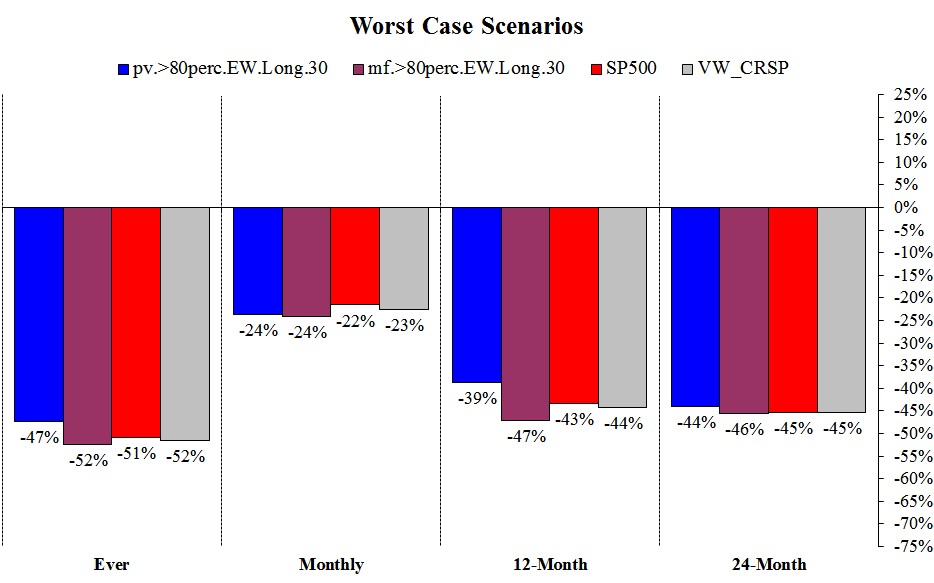

First, the Drawdowns

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Very similar, with a slight edge for profit and value.

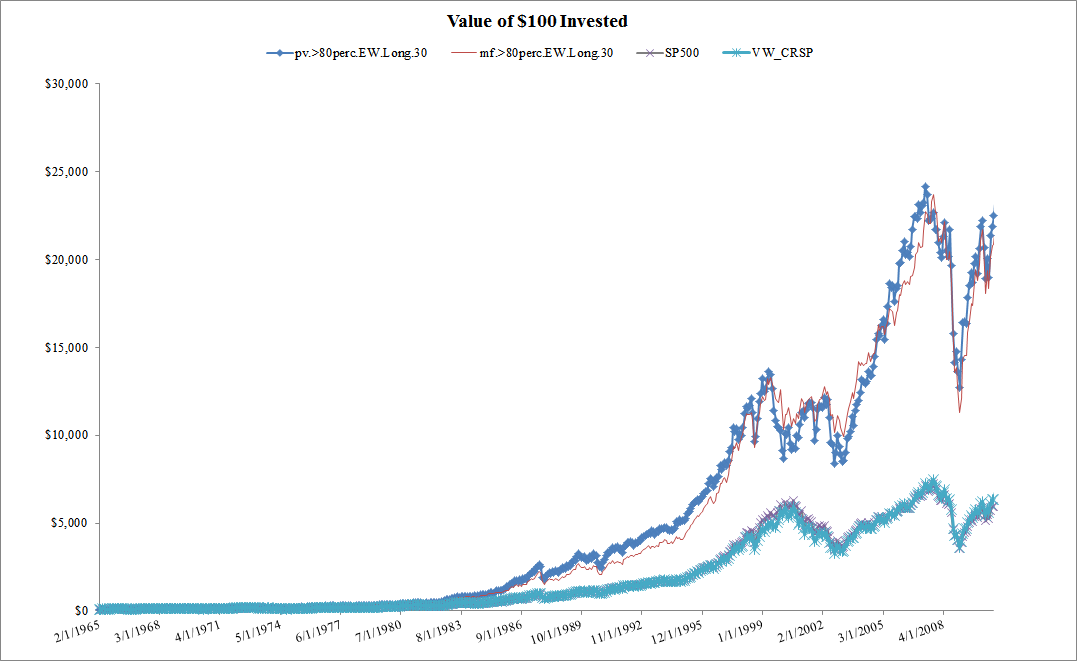

Next, the overall performance

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Again, slight edge for profit and value, but very little overall difference.

And how about the year by year comparison?

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Honestly, looks like a pretty even match–amazingly similar!

Key Takeaway

Focusing on quality and cheapness simultaneously helps investors beat the market

However…

THE MAGIC FORMULA AIN’T THAT MAGIC!

Additional study…

Here is a document with the summary results of the comparison between profit and value and the magic formula for broad market (as defined as market cap >20% breakpoint on the NYSE) and for large caps, exclusively (as defined as market cap >80% breakpoint on the NYSE):

Click to get the pdf file.

Key Takeaways:

- Profit and value is arguably better than the magic formula.

- Both strategies have significant risk in the form of large drawdowns.

- Long/short systems based on quality/cheapness factors are DANGEROUS!

Recommendation:

Explore the use of quality/cheapness factors for long-only investment systems, but be prepared for a very volatile ride. We recommend investors read our book, Quantitative Value, and look at our Quantitative Value Index for an alternative take on how to improve the magic formula.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.